|

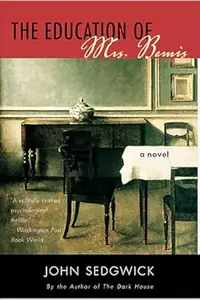

Free Download Michael M. Chemers, "The Figure of the Monster in Global Theatre: Further Readings on the Aesthetics of Disqualification" English | ISBN: 1032558377 | 2024 | 208 pages | EPUB | 1399 KB Bringing together international perspectives on the figure of the "monster" in performance, this edited collection builds on discussions in the fields of posthumanism, bioethics, and performance studies. The collection aims to redefine "monstrosity" to describe the cultural processes by which certain identities or bodies are configured to be threateningly deviant, whether by race, gender, sexuality, nationality, immigration status, or physical or psychological extraordinariness.  Free Download The Female Archangels: Empower Your Life with the Wisdom of the 17 Archeiai by Calista English | September 26, 2023 | ISBN: 1644118416 | 352 pages | MOBI | 57 Mb Embody the Divine Feminine wisdom and consciousness of the Heavenly Archeiai  Free Download The Fastest Diet: Supercharge your weight loss with the 4:3 intermittent fasting plan by Victoria Black, Gen Davidson, Krista Varady English | May 21, 2024 | ISBN: 1761263323 | 240 pages | MOBI | 45 Mb One of the world's leading researchers on intermittent fasting, Dr Krista Varady, teams up with the world's largest online fasting network, SuperFastDiet, to show you how to supercharge your weight loss and dramatically improve your health.  Free Download The Fair Value of Insurance Business By Luke N. Girard (auth.), Irwin T. Vanderhoof, Edward I. Altman (eds.) 2000 | 322 Pages | ISBN: 1461370906 | PDF | 7 MB Insurance companies, as well as banks and thrift institutions, have traditionally reported assets and liabilities on the basis of their amortized cost, or book value. But following the turmoil in securities markets due to highly volatile interest rate fluctuations in the 1980s and the early 1990s, and problems caused by inadequate liquidity, in the mid-1990s the Financial Accounting Standards Board (FASB) issued a new ruling calling for financial intermediaries to report the fair, or market, value of most assets. Called FAS 115, this new standard is the first step in the eventual change to valuing all the assets and liabilities belonging to financial intermediaries under the fair value accounting method. Thus, these changes will pose tremendous future implications for three key business measures of a financial intermediary: Solvency: if the fair values of assets and liabilities are out-of-step, then healthy companies may report negative net worth and insolvent companies may appear to be in sound financial condition. Reported Earnings: if the fair values of assets and liabilities are out of step, then reported earnings will not accurately represent the financial operations of the company. Risk Management: FASB recently postponed the implementation of its new rules on accounting for the use of derivatives instruments. However, if the final set of rules for figuring the fair value of derivatives is not carefully crafted, it may be possible that companies prudently hedging their risks are subject to penalties in their financial reports, while companies taking greater risks appear to have less volatile financial performance. Compared to banks and other financial intermediaries, life insurance companies have the longest term and most complex liabilities, and hence the new FASB requirement poses the most severe challenges to the life insurance industry. The lessons learned from the debate among life insurance academics and professionals about how respond to the fair value reporting rule will be instructive to their counterparts in other sectors of the insurance industry, as well as those involved with other financial institutions. Of particular note are the two papers which comprise Part III. The first provides examples of the fair valuing of annuity contracts, while the second offers examples of the fair valuing of term insurance products. As the papers collected in The Fair Value of Insurance Business extend and update some of the issues treated in a previous Salomon Center conference volume, The Fair Value of Insurance Liabilities, this new volume may be viewed as a companion to the earlier book.  Free Download The Ethics of Humanitarian Intervention: An Introduction by Parry, Jonathan English | 2025 | ISBN: 1138082341 | 189 pages | True PDF EPUB | 9.46 MB  Free Download The Essential Guide to Creating Multiplayer Games with Godot 4.0: Harness the power of Godot Engine's GDScript network API to connect players in multiplayer games by Henrique Campos English | December 22, 2023 | ISBN: 1803232617 | 326 pages | EPUB | 10 Mb Level up your Godot 4 networking skills with the only comprehensive multiplayer guide written by experienced game designer and developer, Henrique Campos, featuring dedicated servers and persistent worlds, illustrated with key images in color  Free Download The Elgar Companion to the World Bank by Antje Vetterlein, Tobias Schmidtke English | 2024 | ISBN: 1802204776 | 457 Pages | PDF | 63 MB  Free Download The Eighty Years War: From Revolt to Regular War, 1568-1648 by Olaf van Nimwegen, Ronald Prud'homme van Reine English | 2019 | ISBN: 9087283334 | 500 Pages | PDF | 57 MB  Free Download John Sedgwick, "The Education of Mrs. Bemis: A Novel" English | 2003 | pages: 409 | ISBN: 0060512598 | PDF | 1,1 mb A dead body floating by a pier. An elderly woman curled up on a bed in a department store. A psychiatrist searching for her own identity. These are the pieces of the puzzle that, in John Sedgwick's masterful novel of psychological suspense, begin to come into focus when Madeline Bemis is referred to the treatment of Dr. Alice Matthews at Montrose Psychiatric Hospital.  Free Download The Economics and Politics of Choice No-Fault Insurance By Edward L. Lascher Jr, Michael R. Powers (auth.), Edward L. Lascher Jr., Michael R. Powers (eds.) 2001 | 344 Pages | ISBN: 0792374673 | PDF | 10 MB In recent years, choice no-fault has emerged as a popular but controversial proposal for addressing the problem of high automobile insurance rates. Choice plans offer consumers the option of a lower-cost insurance policy with restrictions on filing lawsuits or a higher-cost policy with full tort rights. Some American states have implemented choice programs, and major federal choice legislation is now pending in the United States Congress. Choice no-fault has caught the attention of policy makers, the insurance industry, and academics. Until now, however, no single book has pulled together the available research on the topic. The Economicsand Politics of Choice No-Fault Insurance fills that gap. Edited by scholars from different disciplines, each of whom has written extensively on automobile insurance issues, the book includes some of the best work in the area. Former Massachusetts Governor and presidential candidate Michael S. Dukakis wrote the foreword. Contributors include University of Virginia Law Professor Jeffrey O'Connell, widely considered the `father of no-fault,' as well as authors of the influential RAND study of the potential effects of choice no-fault on insurance rates. The book chapters, most of which were written especially for this volume, cover topics ranging from the impact of choice no-fault on accidents and driving behavior, to the effects of choice on medical care usage, to alternative approaches for resolving accidents involving both `no-fault' and `tort' electors, to the political feasibility of choice legislative proposals. Emphasis on the potential advantages of choice no-fault is balanced by consideration of possible ill effects. |